|

Starting today (Thursday, April 26th) the provincial chamber network of about 130 chambers of commerce and boards of trade will gather in Hamilton for the Ontario Chamber of Commerce Annual General Meeting (OCC AGM).

The event will feature a lunch with Canada’s Ambassador to the US David McNaughton, break out discussions on a variety of topics that will help guide chambers in helping their members, and the policy resolution debate which sets the policy agenda for the network. This year the Peterborough Chamber is putting forward three resolutions for consideration.

Mitigating the Impact of Bill 148 This resolution offers 10 recommendations to government to help mitigate the impacts of the Bill 148 legislation. Among the suggestions is a tax credit to help businesses cover additional costs that were required for a business to prepare for the changes including extra human resources advice, accounting and legal fees. It also asks for compliance issuances before fines with regard to the 170+ legislated changes in the bill, and improvements to Business Education, Scale Up and Charitable tax credits. It asks to create a bracketed small business deduction to encourage growth and that the government take a "reward the good players" approach to recognize employers who have consistently demonstrated positive employment and labour practices. Finally, it asks the government to create defined implementation timelines for legislation that has an economic impact on small business. Maximizing Growth in Built Areas This particular resolution is aimed at helping property owners and municipalities understand the needs and amount of unused space in urban growth areas. The Places To Grow Act identifies density and job targets, but there remains a lot of unused space in urban growth areas with older buildings. Creating a climate to explore these spaces and understand the needs associated with them is crucial to meeting density targets. The recommendation is to use the Mainstreet funding envelope to help fund these studies. Unrealized Heads and Bed Levy Hurts Ontario’s Economic Competitiveness This levy applies to post-secondary, correctional institutions and hospitals and has not been adjusted in 30 years. The levy is paid in lieu of taxes by these organizations. We are asking that the per bed/head amount be increased to $100 and then tied to the Consumer Price Index. This type of action will increase the amount received by municipalities and is more reflective of the cost of providing services to these locations. In all, chambers will be discussing over 50 such policy papers over the course of the weekend. Other resolutions include asking the government to return to the previous calculation of statutory holiday pay, to complete a sector by sector assessment of the new scheduling legislation, to examine and report publicly on time of use electricity pricing, to close the gap on financial literacy, to address the skills mismatch, and to improve digital services for Ontario businesses. Delegates will also hear from the Premier, the Conservatives and the leader of the NDP; and talk about cross-border initiatives, how to work with municipal governments, and mental health in the workplace. The OCC AGM is also a time to celebrate business and community leadership across Ontario. Flying the flag for Peterborough will be President & CEO Stuart Harrison, Board of Directors Vice Chair Ben vanVeen, and Policy Analyst Sandra Dueck. If you love Peterborough, love people, and love business, you’ll love working with us!

We are hiring for our Membership Services Team, a job that requires event planning experience, sales experience, and exceptional people skills. Responsibilities include: • Planning and coordination of multiple events • Implementation of two annual trade shows • Membership Sales and Support This is a full-time position, 8:30am – 4:30pm Monday to Friday with occasional overtime. Applicants will be able to demonstrate: • An absolute passion for strengthening local business • Award worthy customer service skills • Deep knowledge of the Greater Peterborough Community • A squeaky clean online presence • High level tech and social media skills • The ability to remember names • A valid Driver’s License and a reliable car Read Full Job Description Please submit your resume before Thursday, May 3, 2018 at 4pm to: The Greater Peterborough Chamber of Commerce 175 George St. N., Peterborough, ON K9J 3G6 Attention: Human Resources Or Email: [email protected] Please note:

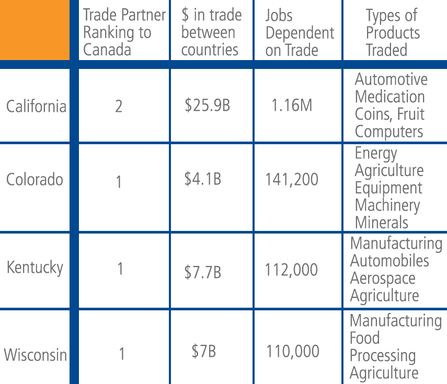

In a recent press release the provincial government has announced where they will be monitoring in the coming year. For more details you can visit the Ministry of Labour website: http://bit.ly/Blitzes2018 News Release Province to Target High-Risk Sectors and Repeat Offenders Ontario is conducting more than two dozen inspection blitzes in 2018-2019 to ensure employers are meeting health, safety and employment standards at workplaces across the province. Enforcement staff will visit workplaces such as warehouses, "big box" retail, grocery stores, chemical manufacturing plants, pulp and paper mills, hotels, golf courses, health care organizations, mines and construction projects. In particular, sectors with new and young workers, temporary help, vulnerable workers and a history of low compliance will be targeted. Occupational health and safety inspectors will look for occupational health and safety violations involving issues such as working at heights, hazardous materials, machine guarding, conveyors, mobile equipment, violence, ergonomics and falls. The goal will be to raise awareness that safety is everyone's responsibility, to enhance workplace health and safety and to prevent workplace injuries, illnesses and deaths. Employment standards officers will check for employment standards violations in the construction sector. The goal is to ensure that workers are receiving their entitlements and employers are aware of, and complying with, their responsibilities.  With negotiations continuing around NAFTA, a presidential election in Mexico scheduled for July 1st and mid-term elections in the United States, building allies around trade is important for Ontario businesses and the Ontario Chamber of Commerce is doing just that. In the past few months they have secured letters from Chambers of Commerce, Industry and Manufacturing from several states including Colorado, California, Kentucky and Wisconsin. Each letter recognizes the importance of continued free trade between the province, each state and Canada. In the letter between the Ontario Chamber of Commerce and Wisconsin Manufacturers & Commerce it is stated that trade supports thousands of U.S. and Canadian jobs and billions of dollars in economic output. NAFTA has created a mutually beneficial relationship between the state and province that will continue to provide economic value for both Wisconsin and Ontario. In fact the letter goes on to reveal that trade contributed “US$22.3 billion to the Wisconsin economy in 2017. And that more than 110,000 Wisconsin jobs are supported by exports and 93 percent of those jobs are in manufacturing. Canada is also Wisconsin’s number one trade partner. Wisconsin exported nearly US$7 billion in goods and services to Canada in 2017 –accounting for almost one-third of the state’s exports. NAFTA has positively impacted Wisconsin and Ontario and is key to continued economic success, as trade between the two jurisdictions adds up to CAN$8.4 billion.” “WMC is delighted to join with our neighbors to the north in support of free trade and the renewal of NAFTA,” said WMC President & CEO Kurt R. Bauer. “Wisconsin is home to manufacturers, food processors and farmers. All of these industries, and others, are supported by free trade, which creates billions of dollars in economic output and family-supporting careers throughout our state. Our relationship with Ontario and the rest of Canada is vital to Wisconsin’s economic future.” “Strong cross-border trade partnerships mutually benefit both Ontario and Wisconsin by driving economic growth and increasing competitiveness.” said Rocco Rossi, President and CEO at the Ontario Chamber of Commerce. “The OCC is pleased to join WMC today in support of NAFTA and free trade. We will continue to work with our Chamber Network, US state chambers and the Ontario government on encouraging the renewal of NAFTA, ensuring prosperity for both our economies.” These types of comments can be seen throughout the letters and its crucial to recognize that trade is a two-way street. Policies that create blockades on that two-way street for exports and imports threaten our ability to make things in Canada. That has an impact on our economy. The Canadian government has started broadening its trading base to the European Union and now the Trans Pacific. These are deals that will diversify how we trade and the countries with whom we trade. For example on CETA, the Canadian Chamber recognizes that the deal presents a number of opportunities across many sectors of the economy:

We recognize that there are both pros and cons, but trade in of itself is a worthy endeavor that will lead to greater growth for our economy and help take the Canadian brand and standards to the next level. It's an opportunity on which we can't afford to close the door. PETERBOROUGH: The Greater Peterborough Chamber of Commerce is proud to be opening the call for nominations for the 15th Annual Peterborough Business Excellence Awards. The awards publicly recognize and honour local businesses who have demonstrated a passion for excellence. The Chamber is pleased to announce the addition of a new category: Professional Services, recognizing businesses showing excellence in the provision of services that require a formal certification by a professional body, such as legal, medical, financial, real estate, etc. “Last year’s move to Showplace was a tremendous success,” says Jim Hill, Chair of the Chamber Board of Directors. “We will build on that this year, our 15th anniversary, with a new category and some surprises.” Please use our Nomination Launch video in any social media or on your website Nominating is easy as 1, 2, 3! Go to excellencepeterborough.ca and

Final Deadline for Nominations – Wednesday, May 23rd at 4:30pm *Nominations received before May 9th at 4:30pm will be entered in our Early Bird Draw to win two tickets to attend the Awards Ceremony plus a $100 gift card for the Chamber member restaurant of choice. We will announce three Finalists in each category on Thursday, August 9th, with the award recipients revealed at the Awards Ceremony on Wednesday, October 17th, 2018 at Showplace. The Peterborough Business Excellence Awards were established to promote the advancement of responsible business leadership within the community. We encourage interested businesses to nominate themselves, or to nominate any qualified individual or business for any of the award categories. Nominees do not need to be members of the Chamber of Commerce. Awards will be handed out in 20 categories including the prestigious Business Citizen of the Year Award. There are categories for every business size & sector: Peterborough Business Excellence Awards Categories 2018

The Greater Peterborough Chamber of Commerce is a member-based organization. Our main focus is to channel the collective strength of the business community to improve the economy.

-30- For further information regarding this event contact: Stuart Harrison, President & CEO The Greater Peterborough Chamber of Commerce 175 George Street North, Peterborough Email: [email protected] Website: www.excellencepeterborough.ca Phone: 705-748-9771 x202 By: Dawn Berry Merriam, Hon. B.A., M.A. Planning & Research Associate, Merriam and Associates and Debby Keating, Manager, Employment Programs & Academic Upgrading Fleming College Following trends throughout Canada, the workforce in Peterborough, Ontario is aging rapidly with more people retiring or leaving work than those entering the workforce. Peterborough recognizes the role that newcomers can play in filling these employment gaps and ensuring economic growth. In 2014 the Peterborough Partnership Council on Immigration Integration (PPCII) produced a report that identified that the ability of newcomers to be successful is contingent on having a local workplace that is open to investing in newcomers, being tolerant of different cultures and learning styles, and providing

training programs that help build English skills and educate on Canadian culture. Over the past two years, Peterborough, like other communities, has welcomed many new refugees due to the Syrian crisis and the community is being encouraged to accept more. In 2016 the Peterborough Immigration Partnership (PIP), a renaming of the PPCII, began working with local businesses and community groups to help them achieve the goals articulated in its Community Immigrant Integration Plan 2016-2021 to ensure that newcomers have a meaningful social and economic integration. Enhanced employment services are part of these goals. Fleming CREW Employment Services recently completed research to identify how employment services can best help newcomers secure and retain jobs to allow them to successfully integrate into our community. The research was designed to answer the following questions:

newcomers, local employers, local employment services and others who support newcomers such as sponsor groups. Input was sought from employment services outside Peterborough who have established services supporting newcomers. Newcomer Voice: “I have trouble with people understanding me!” The report that was prepared identified the barriers that challenge or prevent newcomers from securing and retaining employment. It documents the skills, competencies and characteristics that employers seek in the employees they hire. The analysis goes on to identify gaps in our service delivery system. A series of recommendations addresses how to how to build capacity in the employment and training sector. Newcomer voice: “My greatest asset is giving 100% of my heart.” In essence there is a need to educate and inform employers about the contributions newcomers make and develop an ability to match newcomers to jobs. The report identifies the importance of preparing newcomers for their job search in Canada and providing assistance to newcomers in accessing training and education opportunities. One of the strongest messages was that newcomers need help in navigating and accessing employment and training services – there is a need to develop and deliver a service model for small-mid-size communities that helps address these employment needs. Others that Support Newcomers Voice: “Newcomers think they will have very good English within a year, however, they are facing a reality check that it takes much longer.” These were five key themes that were derived from the research and consultation. A series of recommended directions were developed based on these themes:

Employer voice: “I much prefer to hire someone who I can depend on to show up for work and be focussed on doing their job. If they can do this, I am happy to train them on the hard skills.” Other lessons learned include the need for: diversity training for a changing workplace, mental health supports for newcomers, access to support services in order for newcomers to be able to be successful in the workplace. Newcomer voice: “I feel very much alone and don’t know who or where to turn for help.” As well, two employment service strategies were piloted: a workshop on workplace culture in Canada and a resource tool on employment law in Canada. The workshop and resource tool have been made available to local employment service providers and made available to others across the province at www.flemingcrew.ca/. Read the full report.

With the provincial budget now in the public domain and with the help of our Ontario Chamber of Commerce colleagues, we have broken down the budget pieces with an impact on our business community and offered a Peterborough perspective.

Tax Changes

The Ontario Government is harmonizing with the federal government’s eligibility criteria, leaving over 20,000 employers paying $100 million more in Employment Health Tax over the next three years. In addition, businesses will be phased out of the small business deduction if they earn between $50,000 and $150,000 of passive investment income, resulting in an additional $350,000 million in new taxes for Ontario businesses over the next three years.

In an effort to support businesses making significant, long-term investment in research and development (R&D), the provincial government will enhance the Ontario Research and Development Tax Credit (ORDTC). Companies qualifying for the ORDTC will be eligible for an enhanced 5.5 percent exemption (from 3.5 percent) on expenditures over $1 million in a taxation year. The government is also enhancing the Ontario Innovation Tax Credit (OITC) in an effort to encourage smaller companies to make investments in R&D that will aid growth. If a company qualifies for the OITC and has a ratio of R&D expenditures to gross revenues above 20 percent, it will be eligible for an OITC rate of 12 percent. OCC Anaylsis Budget 2018 has chosen to follow the federal government’s lead on changes to the tax code, resulting in a new tax burden on Ontario employers of nearly half a billion dollars over the next three years.

Peterborough Chamber Perspective

We have significant concerns about the impact the tax changes will have on the cumulative burden of doing business and growing a business in Ontario. We are concerned that following the path of the federal guidelines will not encourage business investment and reinvestment. The enhancements to improve the Research and Development and Innovation Tax Credits are welcome. Innovation is an area on which Peterborough has chosen to focus. Cleantech Commons will be a prime example of industry, post-secondary, and municipal government collaboration while there are numerous companies building their business through the Innovation Cluster with deep connections to industry, Fleming and Trent University. The hope is that these changes will encourage continued commercialization of new ideas and innovations in a timely manner.

Digital Infrastructure

In Budget 2018, the government is providing $500 million over three years to expand broadband connectivity in rural and northern communities. This will include an investment of up to $71 million towards improving cellular coverage in Eastern Ontario and up to $20 million to Telesat to support a Low Earth Orbit (LEO) satellite constellation project.

OCC Analysis The OCC has consistently advocated for trade-enabling infrastructure, including both traditional infrastructure and digital infrastructure such as high-speed broadband internet. The OCC is pleased to see this investment in broadband as the province’s competitiveness relies on infrastructure that can connect communities and open access to foreign markets.

Peterborough Chamber Perspective

The Peterborough Chamber understands the importance of broadband to our economy in the City and County of Peterborough. In fact, at the 2016 Ontario Chamber Annual General meeting we asked that broadband be considered as infrastructure. To stay competitive in Peterborough’s core sectors, including agriculture and tourism, reliable digital infrastructure is the key to future success.

Good Jobs and Growth Fund Skills Development

In Budget 2018, the government has made investments in a variety of areas to expand skills and workforce development and Ontario’s apprenticeships. These investments include $935 million over the next three years for the Good Jobs and Growth Plan and $170 million over three years in the new Ontario Apprenticeship Strategy. Ontario is also investing an additional $12 million to extend the Career Ready Fund to 2020–21, supporting 28,000 more experiential learning opportunities for students and employers.

Other investments include innovative post-secondary programming to match Ontario’s changing labour market, institutional and employer partnerships for experiential learning, bridge training programs for new Ontarians, services to increase access to labour market information, and skills training services for employers. In order to prioritize investments and growth to help Ontario businesses grow and retain jobs, the Province will renew, enhance, and extend the Jobs and Prosperity Fund (JPF) with an increase of $900 million over the next 10 years. In addition, the Province’s New Economy Fund will help companies stay at the leading edge of innovation and industry to create and retain over 20,000 jobs and attract $5.7 billion in investments. OCC Analysis The OCC has consistently emphasized skills and workforce development as a priority for Ontario’s business community, with 77 percent of OCC members stating that the ability to recruit and retain talent is critical to their organizational competitiveness. We commend these commitments from the Province and would welcome further investments and program redesign. For our recommendations with respect to skills and workforce development see the OCC’s report, Talent in Transition: Addressing the Skills Mismatch in Ontario.

Peterborough Chamber Perspective

Without a doubt access to talent is the most common ailment we hear impacting employers. While it is good to see investment in a new Apprenticeship Strategy we encourage the government to include a discussion about the impact of ratios in the discussion. Programs for students and those new to the workforce are not the only way to develop a resilient workforce. We are encouraged by initial announcements to revamp the Canada Jobs Grant and Second Career program to help transition workers into new and developing sectors. The Peterborough Chamber is a member of several committees of the Local Employment Planning Council pilot project and we look forward to learning more about our local market through this process.

Regional Economic Development

The Good Jobs and Growth Plan includes an investment in the Southwestern Ontario Development Fund and the Eastern Ontario Development Fund to support the needs of all businesses, particularly those in rural and small communities. The Province will invest an additional $100 million in these funds over the next 10 years and will aim to create and retain approximately 19,000 jobs and attract more than $800 million in investments.

OCC Analysis

The OCC supports an economic strategy that recognizes and is responsive to the province’s many regional differences. The Ontario Chamber Network looks forward to working with the government and public agencies in ensuring that their investments are well spent. Peterborough Chamber Perspective The Eastern Ontario Development Fund has been very good to businesses in the Peterborough area in the past and the program is a good example of public and private sector investment working together to boost the economy. We look forward to celebrating and connecting our members to more of these partnerships.

Health Care and Child Care

The government is prioritizing spending on care in Budget 2018, particularly with regard to expansions to health care and child care.

The Budget includes total health care investments of $5 billion over three years, with $822 million being devoted to hospitals in 2018-9. This investment will support service demands related to growing and aging population, more hospital beds, new patient spaces, and specialty services. As previously announced, OHIP+ will expand to seniors in August 2019. This program will eliminate the deductible and co-payments for Ontarians aged 65 who already use the Ontario Drug Benefit program. This is estimated it cost $575 million per year by 2020-1.

The Ontario Drug and Dental Program is newly announced in the Budget and will begin in 2019. It will reimburse 80 percent of eligible drug and dental expenses for families without workplace or public health benefits at an expense of $800 million for the first two years of the program.

Finally, the government will spend $2.2 billion over three years to increase child care accessibility and affordability, including free preschool starting in September 2020.

OCC Analysis

While hospital funding has been limited in recent years, this influx of spending does not address the fundamental challenges within the health care system nor is it directed towards the solutions identified by the OCC in our report, Health Transformation: An Action Plan for Ontario. Similarly, the expansion of OHIP+ is not aligned with the principles of an effective pharmacare program outlined in our recent Pharmacare Report. As for investments in child care, the government must find ways to supplement and augment the current market rather than override or replace it. Peterborough Chamber Perspective The Peterborough Regional Health Centre recently received an almost $7 million boost recently from the government. We agree with the Ontario Chamber of Commerce that funding is just one piece of the fundamental changes required to find lasting solutions. Affordable child care and pharmacare have the potential to boost our workforce, however, a blanket approach to either of these also has the potential to have negative effects on our economy.

Debt and Deficit

Budget 2018 forecasts a $600 million surplus for the 2017-18 fiscal year. This is because many new programs announced by this government will only be designed in this fiscal year, with new costs not being realized in a meaningful way for the next one or two years. As such, the government is projecting a $6.7 billion deficit in 2018-19 and further deficits for five more years after that.

With regard to debt repayment, the government has argued that debt repayment has gone from 15 cents per year several years ago to 8 cents, which is the lowest in 25 years. Such an analysis does not take into account that the overall size of the provincial budget has increased exponentially in that time.

OCC Analysis

The OCC is concerned with the precarious fiscal situation that many of the government’s new investments will create. While the near-term deficit is projected to be less than one percent of the GDP, this comes at a time when the economy is relatively strong. The Budget also projects slower GDP growth on the horizon due to global factors. Peterborough Chamber Perspective The lack of a meaningful plan to manage debt and deficit in future years has us concerned, particularly as the government has started to identify the current economy as one that is facing uncertainty. There is also concern about the increase in program spending and how future governments would have to deal with the impact of that should the economy take a turn.

Government Transparency and Accountability

Budget 2018 indicates that the government is committed to modernizing and transforming public services through cost-saving program improvements, reducing duplication through harmonization, scaling down investments that do not demonstrate value for money, and establishing investment priorities to manage overall sustainability.

It similarly notes that the government hopes to harness expertise through consultation, noting that industry leaders, academics, and representatives from the general public will be asked to make recommendations regarding how the government can best achieve its outcomes and improve user experience. OCC Analysis Improving government accountability is one of the four pillars of our Vote Prosperity platform. We have long called for improved value-for-money and return on investment assessments of government programs and services as well as more robust consultation with stakeholders. Peterborough Chamber Perspective For the Peterborough Chamber of Commerce Policy Committee this is one of the most important aspects of developing public policy for small business. In a 2018 policy resolution that will be debated at the Ontario Chamber of Commerce Annual General Meeting at the end of April, the committee recommends that future governments consider economic impact and time frame when developing legislation that will impact small business. |

AuthorThe Peterborough and the Kawarthas Chamber of Commerce acts as a catalyst to enhance business growth, opportunity, innovation, partnerships and a diverse business community. Archives

June 2024

Categories |

|

Copyright Greater Peterborough Chamber of Commerce. All rights reserved.

175 George Street North, Peterborough, ON, K9J 3G6 Phone: (705) 748-9771 | (705) 743-2331 Home | Calendar | Site Map | Privacy | Accessibility |