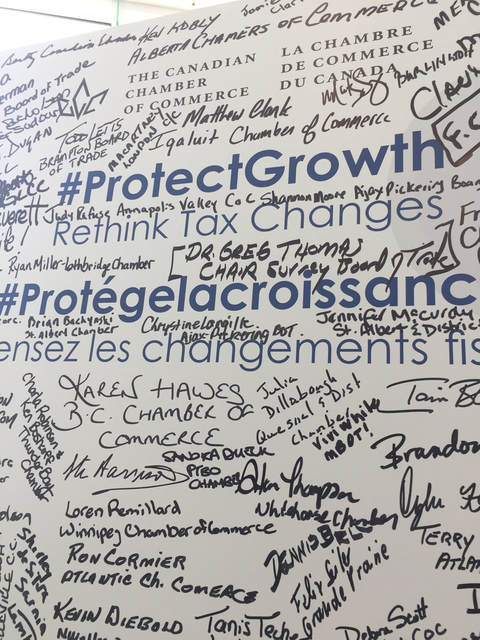

Members from hundreds of chambers of commerce across Canada were not reassured by Finance Minister Bill Morneau’s response to their concerns about the government’s proposed tax changes. The Minister addressed delegates at the Canadian Chamber of Commerce’s annual general meeting in Fredericton on Saturday, September 23rd. “While we are grateful to the Minister for taking time out of his schedule to speak to our members, we did not receive any new information or assurance about the potentially crippling effects his tax reforms could have on small and medium-sized enterprises,” said the Hon. Perrin Beatty, President and CEO of the Canadian Chamber. Following Minister Morneau’s post-speech press conference, Mr. Beatty was accompanied by representatives of provincial chambers and by five local business owners, who are deeply concerned about these measures. “In speaking with our network of more than 200,000 businesses, it is the farmers, mom and pop shops, and entrepreneurs who invested everything into their businesses who are most scared of the government’s proposed tax changes,” Mr. Beatty said. “The government has not answered their concerns today. It has left them high and dry, wondering how they will survive if the weather or the economy takes a turn for the worse.” Delegates at the AGM debated more than 70 resolutions, in setting the Chamber’s policy agenda for the year ahead. Included in this year’s resolutions is a call to government to extend its 75-day consultation period for the tax changes and bring in an independent commission to review the full impact of the changes. “Businesses have a right to be heard. The government’s process on this issue needs to be stopped and replaced with genuine consultations,"concluded Mr. Beatty. Your chamber, in collaboration with the Canadian Chamber of Commerce, has launched Protect Growth, a national campaign to ensure the voice of business is heard before any changes to the tax code are made. The government's proposed changes are the most dramatic in 50 years and could affect you if:

The rules would apply to all incorporated businesses in Canada. Two thirds of small business owners earn less than $73,000 per year and half of those earn less than $33,000. 93% of Peterborough Chamber members are small businesses. For more information about this campaign, and how you can speak up, visit protectgrowth.ca.  The Peterborough Airport has announced a public engagement exercise to determine public support for commuter air service between Peterborough Airport and Toronto Island Airport (Billy Bishop Airport). The first step in attracting a commuter airline to Peterborough is understanding market demand. They invite you to participate in an online survey (9 questions) including a comments section. They invite you to go to SurveyMonkey at: www.surveymonkey.com/r/travelfromptboairport or go to the Peterborough Airport website at peterboroughairport.com to complete the survey. In 2016, the Peterborough Chamber of Commerce identified the airport as one of the Top 10 Opportunities for the Peterborough region. Developing the airport was an intentional decision by the City and County in 2009 and they continue to look for opportunities for more strategic development in this space. According to the airport website, general aircraft movements play a very important role at the Airport. With approximately 55,000 aircraft movements per year; the day to day flight activity includes recreational traffic, commercial jet and turbine engine operations, medivac operators, charter flights, cargo shipments and commercial/college/military flight training activities. The airport has no noise curfews allowing unrestricted operation of freight and passenger flights. Currently, the Peterborough Airport (YPQ) is part of the Southern Ontario Airport Network (SOAN). The goal of the group is to meet the growing demand for air travel given the region's potential, and its many air transportation assets. Through responsible planning, the SOAN will ensure that the region is well placed to keep the jobs and economic benefits of air service demand in Southern Ontario. Final analysis of Bill 148 reveals $12 billion economic problem that the Ontario Government must resolve Peterborough, ON, Wednesday, September 27, 2017 - Today, the Peterborough Chamber, in collaboration with the Ontario Chamber of Commerce (OCC) and the Keep Ontario Working (KOW) Coalition released two major reports that broadly capture the challenges associated with Bill 148 and the concerns of the employer community.

The first report is the final economic impact analysis of Bill 148 by the Canadian Centre for Economic Analysis’ (CANCEA), which was peer-reviewed by Professor Morley Gunderson of the University of Toronto. CANCEA’s analysis reveals that if Government were to do nothing other than implement the minimum wage increase over five years instead of in the next 15 months, jobs at risk would decrease by 74 per cent in the first two years. The analysis also indicates that while the proposed changes will see $11 billion in wage stimulus flow into the economy in the next two years, a remaining $12 billion problem exists which will lead to jobs lost, added costs, and general damage to the Ontario economy. “Today’s final report by CANCEA is clear, while the Government is correct to say that there will be a stimulus from Bill 148, it does not cover the $23 billion cost challenge for business in the first two years – a substantial amount that poses great risk to our economy and cannot be resolved through offsets alone,” said Karl Baldauf, Vice President of Policy and Government Relations at the Ontario Chamber of Commerce. “More must be done. The Ontario Government must resolve the economic challenges presented in Bill 148 through a combination of slowing down the implementation period, amending the legislation, and offsets. Business and Government must work together to avoid unintended consequences and protect our most vulnerable.” The Keep Ontario Working Coalition and CANCEA released interim findings of this Analysis in August, ahead of final amendments being submitted for first reading of the legislation. To date, CANCEA’s work remains the only peer-reviewed economic analysis of Bill 148. In having been reviewed by Morley Gunderson, the work has benefited from one of the leading economists in Canada, who the Ontario Government has turned to on multiple occasions, such as during the Changing Workplaces Review which became the foundation for Bill 148. “Our risk assessment of the Act is that there is more risk than reward for Ontarians despite the stated goal of the legislation in helping Ontario’s more vulnerable and the Ontario economy,” Paul Smetanin, President of CANCEA. “Given the risk of consolidating income and wealth inequality, putting about 185,000 people out of work, and the risks of small/medium businesses being exposed to their larger competitors, the unintended consequences are significant.” In addition, the Keep Ontario Working coalition released a second report, The Flip Side of “Fair”, which showcases testimonials from employers and outline how they will be impacted by the legislation. The report gives a voice to those businesses who have felt excluded from the committee process and policy discussion around this legislation. The testimonials all share a common theme, that the minimum wage increase and labour reforms will have serious consequences for their business and their communities. “I am an owner of three automotive oil change service stations, which I purchased for a significant amount. I employ 29 employees at my three stores. All are hardworking and live in the communities we serve. We were on track to grow locations and further invest but for many reasons this new proposed legislation has put a stop to our plans. At our average wage, our labour percentage to sales is 32 percent. With the proposed changes, we would see this rise to 40 percent of sales. This is just not feasible to absorb. That leaves us with no option but to raise prices to adjust to the increase. The 16% increase in just basic wages means our prices will need to increase by at least 22% to manage this proposal properly. My wife and I purchased the business on a set of income statements that had labour at a certain percent. Now that labour will jump, my business valuation will be reduced by 4 times that amount. Overnight, the government has de-valued my business. Bill 148 will impact financing thresholds and deter new entrepreneurs from purchasing existing businesses.” - Owner, three local oil change stations The KOW Coalition will continue to advocate that the government:

CANCEA FINAL REPORT The Flip Side of “Fair” For more on Peterborough Chamber advocacy on Bill 148 The Keep Ontario Working Coalition (KOW) is a broad-spectrum group of business sector representatives concerned with sound public policy to help produce jobs and grow Ontario. For more information please visit www.keepontarioworking.ca. Members include: Association of Canadian Search, Employment and Staffing Services (ACSESS) Canadian Franchise Association (CFA) Canadian Federation of Independent Grocers Food & Consumer Products of Canada (FCPC) Food and Beverage Ontario (FBO) National Association of Canada Consulting Businesses (NACCB Canada) Ontario Restaurant, Hotel and Motel Association (ORHMA) Ontario Chamber of Commerce (OCC) Ontario Federation of Agriculture (OFA) Ontario Forest Industries Association (OFIA) Ontario Home Builders’ Association (OHBA) Ontario Real Estate Association (OREA) Restaurants Canada Retail Council of Canada (RCC) Tourism Industry Association of Ontario (TIAO) MEDIA CONTACT: Sandra Dueck, Policy Analyst/Communications Specialist Peterborough Chamber of Commerce [email protected] 705.748.9771 x215  This weekend Chamber of Commerce delegates from across Canada will be gathering to debate a series of policy resolutions. The resolutions, if passed, will set the policy agenda for the coming year for the Canadian Chamber of Commerce (CCC). The Peterborough Chamber of Commerce has submitted two resolutions for consideration and is a co-sponsor on two others. One of the threads tying each together is a focus on small business. In Assisting Small Business with Minimizing the Risk and Recovery from Cybercrime, we are asking the government to “allow SMEs to write off 100% of their business investments in cybersecurity-related software, equipment and other costs (support services and outsourcing costs) in the year those investments are made." The rationale behind the resolution is to encourage more small businesses to invest in this area of their business and to help address financial challenges that may keep SMEs away from cybersecurity measures. According to StaySafeOnline.org, 71% of data breaches happen to small businesses, nearly half of all small businesses have been the victim of a cyber attack, and that the dollar value of attacks is also on the rise (CCC’s Cyber Security in Canada). The second policy resolution is titled “Driving Innovation in Canada”. This policy resolution turns the spotlight on intellectual property with four recommendations:

We thank our members and co-sponsoring Chambers for their feedback and support of these resolutions. One of the resolutions on which the Peterborough Chamber is a co-sponsor asks the federal government to "reevaluate the existing business categories identified by number of employees to determine if the current definition of small business is accurately reflected by 100 employees or less." The resolution, put forward by the Trent Hills Chamber of Commerce, also identifies that businesses with 19 employees or less account for 86.2% of employer businesses and according to the Key Small Business Statistics Report, June 2016, “…the contribution to net employment change between 2005 and 2015 (1.2 million jobs) was 87.7% attributable to small business.” The second resolution on which we are a co-sponsor asks for a concierge service geared toward helping businesses with regulation and compliance. The recommendations stress the need for this type of service to span the varying levels of government and for swift implementation and integration into the Canada Business Network. Delegates will debate these and 70 other resolutions in Fredericton, NB this weekend as part of the Canadian Chamber of Commerce AGM. In a world of back to school and back to your regular work schedule after the summer of 2017, Members of Provincial Parliament return to the legislature to begin work on the fall session. It’s a session that will be under the watchful eye of the business community as Bill 148, Fair Workplaces, Better Jobs Act moves through the legislative process.

Over the past number of months the business community has pushed back on the government’s proposed legislation around minimum wage, scheduling, vacation and sick pay, and rules around forming unions, calling the sweeping changes “too much, too soon.” In isolation, these changes could be manageable, but for many small businesses, even those paying above the minimum wage currently, the combination of new requirements could be too much to overcome. As we get closer to the end of the year, businesses are still left not knowing if these changes will go through on January 1st as designed or if the call to slow down the process will be heeded. In mid-August the Ontario Chamber of Commerce and the Keep Ontario Working coalition released an economic analysis on the proposed changes. “The results of the economic analysis reinforce the concerns of fewer hours, fewer jobs that were presented at a roundtable we held with local businesses and Jeff Leal, the Minister Responsible for Small Business in mid-June,” says Stuart Harrison, President & CEO, Peterborough Chamber of Commerce. ”Bill 148 is too much, too soon and the uncertainty it presents to business has the potential to have significant impact.” In their comments to the Peterborough Chamber, several businesses have said their expansion plans are on hold as they come to terms with how the multitude of changes in Bill 148 will affect their business in a very quick time frame. While other businesses have indicated the changes will force them to reconsider how they run their operations, the number of students they will be able to hire, or work within budgets. So to recap what are some of the changes that will have the most impact?

Commentary on Bill 148 continues to be very important and we ask our member businesses if you haven’t already, tell us and your elected leaders how these changes will impact your business. Email the Chamber: [email protected] Write your MPP and cc the Premier: Honourable Jeff Leal, Minister Responsible for Small Business [email protected] Honourable Kathleen Wynne, Premier of Ontario [email protected] Peterborough Chamber is a Finalist in the National Chamber Competition for the Second Year in a Row9/11/2017

Peterborough, ON, September 11, 2017: The Canadian Chamber of Commerce has announced the five finalists for the 2017 Canadian Chamber Competition:

The Peterborough Chamber of Commerce submission titled “The Amazing Things That Happened When We Said Yes to Video” details how the addition of video for our #lovelocalptbo sponsors has allowed us to effectively tell the story of these members and what it means to be a local business and a member of the Chamber of Commerce. “Our members drive us, and channeling the collective strength of the business community gives us a focused voice on a variety of issues. Apart from the lobbying work we do, helping our members grow helps the local economy,” Stuart Harrison, President and CEO Peterborough Chamber of Commerce. The Peterborough Chamber submission also highlighted how staff use video to welcome new members and recognize member milestones through the ChamberLIVE videos on Facebook and breaking down the advocacy issues of the day with the Voice of Business videos. VIDEO NEWS RELEASE For further information contact: Sandra Dueck, Policy Analyst/Communications Specialist Greater Peterborough Chamber of Commerce 705.748.9771 x215 [email protected]  The official plan for the City of Peterborough is inching closer to being presented to council. Currently in the second round of community engagement planning, officials want to hear from you. In the end, as explained on the City website, an official plan will be “a legal document which sets the vision and direction that shapes the growth and development of the city to the year 2041. By the year 2041, the City is expected to grow to a population of 115,000 people and 58,000 jobs – an increase of about 32,000 people and 10,000 jobs from 2016.” Planning officials stress that hearing from all community members is important because, “whether you work or live in the city, the Official Plan affects just about every aspect of your daily life – it provides strategic policy direction on the:

Phase One (2011-2013) included a review of the current plan, community engagement on the current plan, a community visioning exercise with numerous stakeholders to identify vision principles, and determining the overarching themes for the new plan. These were:

Phase Two (2013-present) includes the development of draft policies, reaching back into the community for input (this is the current stage), and then finalizing the plan and taking it to council. The design of the Official Plan is called “Plan It Peterborough” and “ensures the growth and development of a city is managed to balance the interests in our built, natural, economic, and social environments and sets the priorities for our city’s future.” To provide feedback during this latest round of community engagement, the city’s third survey on the official plan is looking for input on Vision and Guiding Principles. The survey will be open until September 20, 2017. Find more background information, upcoming events, reports and presentations, FAQs, and relevant links all related to the Official Plan Review. Here are three tips to be next level for any entrepreneur or startup:

Thanks Rosalea for attending the Next Level Ptbo event on August 29th, 2017! Author: Rosalea Terry, Marketing Manager & Innovation Specialist, Innovation Cluster Peterborough and The Kawarthas |

AuthorThe Peterborough and the Kawarthas Chamber of Commerce acts as a catalyst to enhance business growth, opportunity, innovation, partnerships and a diverse business community. Archives

June 2024

Categories |

|

Copyright Greater Peterborough Chamber of Commerce. All rights reserved.

175 George Street North, Peterborough, ON, K9J 3G6 Phone: (705) 748-9771 | (705) 743-2331 Home | Calendar | Site Map | Privacy | Accessibility |