|

Finance Canada is proposing the most radical tax overhaul in 50 years. These proposed changes will have impact on all incorporated businesses in all sectors of the economy from retailers to restauranteurs to farmers and consultants. We are concerned that these changes will stall business growth in Canada and punish legitimate businesses. Over the next few weeks, MPs will be attending caucus meetings and we want to send our MPs to those meetings with a number of stories about the impact the proposed changes will have on businesses in our community. We are asking for your help:

Write a letter to your MP: Maryam Monsef, Minister of Status of Women, Peterborough-Kawartha (LIB) Kim Rudd, Northumberland-Peterborough South (LIB) Jamie Schmale, Haliburton-Kawartha Lakes-Brock (CONS) We urge the government to put these changes on hold to avoid hurting thousands of small businesses across the country and to have a broader, more thoughtful discussion regarding the measures needed to stop those who use their businesses to avoid paying taxes.

What does it mean to be a business owner? It takes somebody willing to risk it all to see their idea blossom from the kitchen table to a bricks and mortar building or even an online presence. It takes someone willing to spend the countless hours navigating the regulations and legislative requirements of at least three levels of government. It takes someone with drive to constantly battle, like a salmon upriver, to ensure the jobs they’ve created remain viable. It takes someone with a sense of community because most business owners also give back to the community they live in. Interestingly enough, at a time when we are seeing more and more people take on the dream of entrepreneurship the provincial and federal governments are looking more and more at small business with a critical eye. As presented in a recent Ontario Chamber of Commerce (OCC) report, Canadians now create new firms at a higher per capita rate than Americans, partly a result of the rapid growth of the start-up ecosystem. As such, Canada currently ranks as a global leader in entrepreneurship, particularly for early stage projects. In Peterborough there is a tremendous ecosystem of organizations ready to help and offer a hand up to see new ideas become realities and tested ideas soar. But where Canada fails as a nation is seeing the majority of those start-ups continue to scale into larger and successful small businesses or even medium or large businesses. The OCC report looked at what were some of the barriers holding back those start-ups from developing from one person operations to being sustainable enough to hire and create jobs in our communities. In the report it was revealed that over the past ten years, for example, 71 percent of the jobs created in the private sector can be attributed to the activities of small and medium-sized enterprises. Why are we going over all of this? Because proposed changes to the tax system will have a major impact on the continued growth of small and medium sized businesses. And it threatens to disrupt the entrepreneurial ecosystem that has been driving Canada’s economy one job at a time. In a white paper titled “Tax Planning Using Private Corporations” by the Department of Finance, the Finance Minister says “in the last year the economy added more than 300,000 new jobs.” That’s a bit misleading and takes away from the real work that lead to those new jobs. Let’s be clear. The faceless economy did not add those jobs. Business owners did. Business owners in communities across Canada worked for contracts, increased their sales, and invested in new equipment (perhaps even with the assistance of a government program). As a result, those business owners were able to offer those jobs. That’s how they became a part of the economy. The Canadian Chamber of Commerce (CCC), along with many in the accounting profession, believe the proposed rules could potentially raise taxes, increase the administrative burden on SMEs and heighten the impact on family-run businesses. On July 18, Finance Canada launched its 75 day consultation outlining four key changes that will affect businesses structured as private corporations:

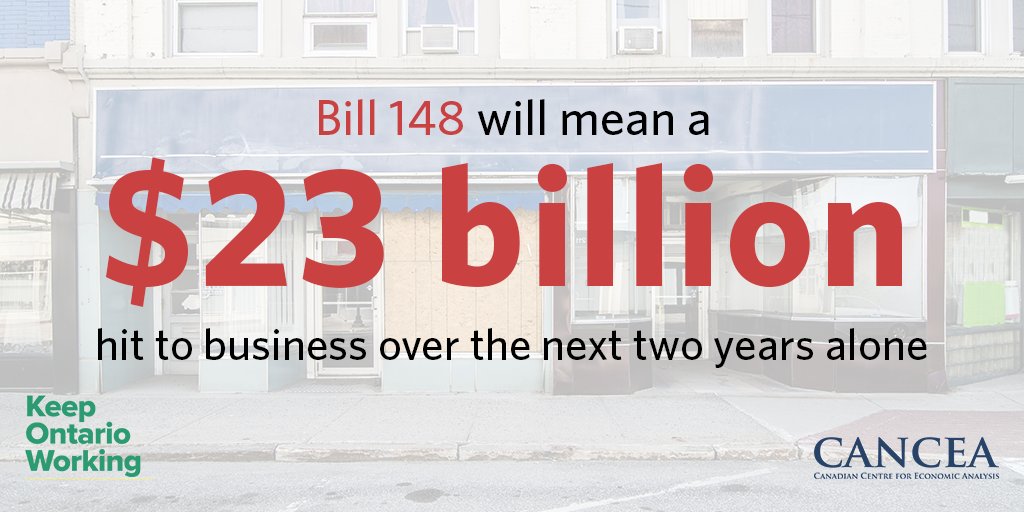

These proposed tax changes apply to all businesses across all sectors from retail to landscapers to farmers and manufacturers. The current system has allowed for growth and jobs. The proposed changes threaten to make it more difficult to be a business owner stifling growth and jobs. The economy doesn’t create jobs, the business owner does. Give them tools to continue to do so and their success will also be Canada's. Comments on the white paper and proposed changes are open until October 2, 2017 and comments can be emailed to [email protected] Canadian Chamber 5 Minutes for Business Article MP Maryam Monsef -Peterborough-Kawartha MP Kim Rudd - Northumberland-Peterborough South MP Jamie Schmale - Haliburton - Kawartha Lakes - Brock  To date there has only been one study done on the proposed impacts of Bill 148, the controversial bill proposing changes to numerous labour laws and a $15 minimum wage. That study was released earlier this week by the Ontario Chamber of Commerce and the Keep Ontario Working Coalition. Proponents of the proposed legislation have been quoting other research from other communities, but the time has come to focus on Ontario and try to determine what these changes will mean for our economy and our communities. The government has not been willing to complete an economic analysis on the proposed changes under Bill 148. The study released this week was conducted by the Canadian Centre for Economic Analysis (CANCEA). CANCEA has done a significant amount of work on the issues addressed, including work for multiple Ministries within the Provincial Government. They do not accept research funding that requires a pre-determined result, and the design and methodology of this study was determined solely by CANCEA. Their findings include:

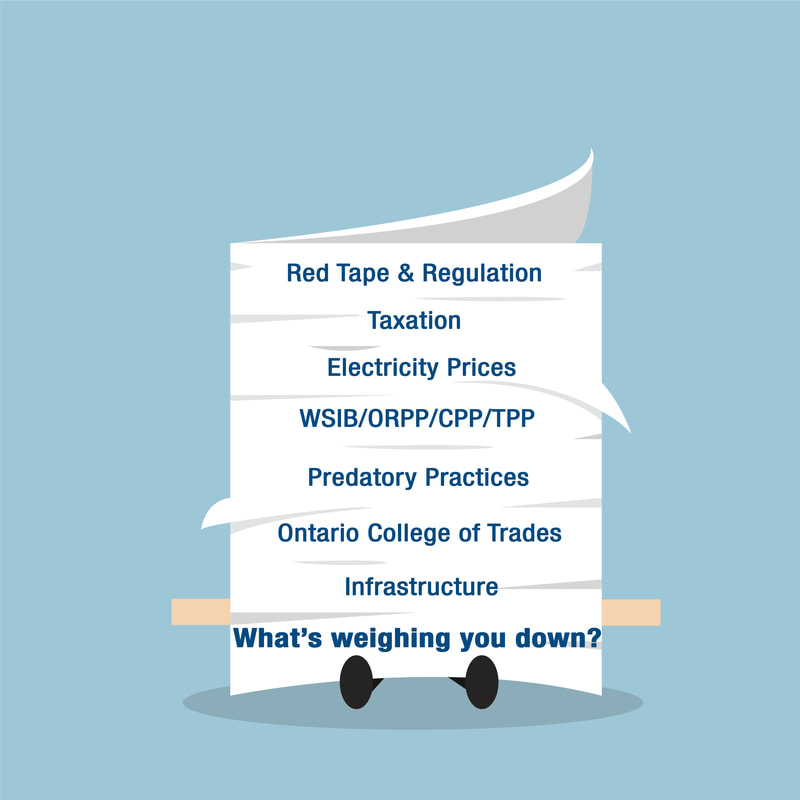

Several businesses in their comments to us have said their expansion plans are on hold as they come to terms with how the multitude of changes in Bill 148 will affect their business in a very quick time frame. Simply put, the time frame for implementation of the changes to minimum wage, sick days, vacation days, scheduling and unionization is too fast. This bill is still going through the legislative process and would only become official sometime in October. There is also a 20 cent increase to minimum wage scheduled for October 1st. That gives businesses only two or three months to make adjustments. The argument keeps arising that increasing the minimum wage in this quick time frame will reduce the need for social services programs and, from the Premier herself, that more money will be circulating in the economy. This too calls for more evidence-based thinking: How many people will have less dependence on social services programs? How will the government reinvest the savings? By what percentage can businesses expect their sales to go up with all this new money being pumped into local economies? Proponents have been citing examples such as BC and Alberta, that are increasing their minimum wage. However, neither jurisdiction is making a $3.40 jump in 14 months. In BC, the increase was at 75 cent intervals from May 1, 2011 to May 1, 2012 for a total increase of $2.25 to $10.25. Then in September of 2015, BC minimum wage went up $.20 to $10.45, in September 2016 it went to $10.85 and next month it will go up $.50 to $11.35. The increase in Alberta has been on a three-year trajectory of $1.00 in 2016, $1.40 in 2017, and another $1.40 in October of 2018. Those increases are based on research that a gradually increasing minimum wage has little impact on employment levels. That said, colleagues in Alberta tell us that the jump from $12.20 to $13.60 is a great concern for businesses in that province and that there will be some hard choices made. In Seattle, where they have reached $15, a recent study revealed that those individuals the minimum wage increase was supposed to benefit are actually taking home $125 less per month. "As for the economists who publicly supported the move to $15 in a letter recently, 30 of them aren’t even from Ontario, the letter has zero reference to an appropriate time frame for such an increase, none of them have ever had to make payroll, and their findings don’t match what we are being told by local small business owners. Business owners who know what it means to employ people,” adds Harrison. To suggest that there are only positive impacts from the changes in this legislation is to willfully ignore the impact of a whole bank of constituents. All legislation has pros and cons and fully understanding the impact has never been more important. A responsible government means being fair to all constituents under its guard – especially when one group is bearing the weight and full responsibility of any proposed changes.  The 5 Minutes for Business article (below), printed in its entirety, is about the biggest challenge facing business at all levels of government -cumulative burden, or the true overarching cost of being in business. The focus of the article by Hendrik Brakel of the Canadian Chamber of Commerce (CCC) is in the CCC's dealings with the federal government, but there are other pieces of legislation in the provincial and municipal realms that play significant roles in the cumulative burden on business. Business owners do not have the luxury of isolating the various input costs and regulations they face each day. Cumulative expenses such as high electricity prices, sector-specific costs for materials, compliance, wages, the upcoming changes to WSIB models, workplace requirements, and CPP enhancements have the potential to be overwhelming and ultimately impact competitiveness. 5 Minutes for Business: Every so often, one of our government contacts will ask a question that goes like this, “Why is the Canadian Chamber complaining about (pick one): the new carbon tax/the CPP premium increase/the deferral of small business tax reductions/the proposal to tax passive income/this new regulation/that increase in fees? It’s not a huge cost to business. Why are you making a big deal?” We politely explain that all of these tax increases come out of the same pocket. If you take one of these tax hikes individually, it may be small, but when you add them all up, we’re accumulating a rather large pile of straws on the camel’s back. And that’s the problem. Canada is an expensive place to do business. Last week, the President and CEO of the Canadian Chamber of Commerce and his provincial and territorial colleagues wrote to the Prime Minister to point this out. The letter was also sent to all of the provincial premiers because, right across the country, we are worried that “the cost of doing business in Canada is rising. This concern is not limited to the costs generated by the fight against climate change, but reflects the serious cumulative impact of the growing burden posed by fees, taxes and regulations the private sector is being asked to bear. Our members are deeply worried about their ability to both grow their businesses within Canada or compete for investment and customers from abroad. This concern becomes even more substantial when we see the determination of the U.S. administration to dramatically cut both regulation and business taxes in that country.” As luck would have it, our letter was published on the same day that Petronas cancelled a $36-billion LNG investment in British Columbia. It’s impossible to pin the blame for the decision on any one factor (Petronas vaguely cited “market conditions”), but the uncertainty around project approval, along with regulatory, tax and cost burdens all contributed. The effect is a loss of jobs for Canadian families, truly a missed opportunity for Canada. It’s not just Petronas, Canada has seen a mass exodus of investment, a staggering $60 billion has left over the past two years (in 2017, Shell divested $7.5B, Marathon sold $2.5B and ConocoPhillips $17.7B. Most has gone to other jurisdictions). And we’ve seen some of the players shedding Canadian energy assets while investing more in the U.S. It’s true that U.S. shale enjoys a modest cost advantage over oilsands production, but we worry that Canada’s high costs and dithering over pipelines is having a big impact. As the Globe and Mail pointed out last week, “It’s beginning to feel it is becoming impossible for any new interprovincial pipelines to ever get built […] because of obstructionist games played by premiers and mayors. […] Environmental benefit: Nil. Economic cost: High.” And it’s not just oil and gas. Last week, we sat down with a major multinational agri-food producer who told us that, for his company, regulations are a bigger cost than taxes. The company was struggling with Canada’s new food labelling rules and asked if the current government is “sensitive” to the cost burden of regulation. I said the word “sensitive” is too strong. “Blissfully unaware” might be a better descriptor. The government wants to attract more foreign investment, but in a tough globalized environment. What really attracts investors is the rate of return. That’s why costs, rules and regulations are so important. And they have real world impacts on Canadian families and their prosperity. Last week, we wrote to the Prime Minister, “As we increase business costs to address climate change, we urgently need to find ways to lower costs elsewhere. […] to strengthen Canada’s economic competitiveness.” Global capital can go anywhere. The wolf is at the door. Find this 5 Minutes for Business article and others at chamber.ca Independent Economic Impact Analysis reinforces the concerns of Peterborough businesses around Bill 148 Bill 148 will put 185,000 jobs at risk in Ontario and increase the cost of consumer goods and services by $1,300 per household starting in 2018, according to new analysis by leading economics firm PETERBOROUGH, Monday, August 14 - Today the Keep Ontario Working Coalition (KOW), in partnership with the Ontario Chamber of Commerce (OCC) and the Greater Peterborough Chamber of Commerce released the first and only independent economic impact analysis of Bill 148, the Fair Workplaces Better Jobs Act. Conducted by the Canadian Centre for Economic Analysis (CANCEA), the study revealed that if the legislation is implemented as currently drafted, there will be significant, sudden and sizable uncertainty for Ontario jobs, economy and communities.

The study also shows that small businesses are likely to be affected five times more than larger business. “The results of the economic analysis presented today reinforce the concerns that were presented at a roundtable we held with local businesses and the Minister Responsible for Small Business in mid-June,” says Stuart Harrison, President & CEO, Peterborough Chamber of Commerce. ”Bill 148 is too much, too soon and the uncertainty it presents to business has the potential to have significant impact.” In the regional analysis of impact, CANCEA predicts that just over 2.7% of jobs in Peterborough will be at risk, which is above average when compared to other areas of the province. They say the impact depends on demographics and industry in each region. “The changes presented in Bill 148 will have dramatic unintended consequences that include putting 185,000 jobs at risk and seeing everyday consumer goods and services increase by $1,300 for each and every family in Ontario,” said Karl Baldauf, Vice President of Policy and Government Relations at the Ontario Chamber of Commerce and spokesperson for the Keep Ontario Working Coalition. “We’ve run the numbers, if the Ontario government chooses to proceed with these sweeping reforms too quickly, all of us will be affected, and the most vulnerable in our society chief among them.” CANCEA was commissioned by the KOW coalition to measure the potential impacts of six key areas of change in Bill 148, including changes to minimum wages, “equal pay” provisions, vacation, scheduling, personal emergency leave (PEL) and unionization. Data from the economic impact analysis shows:

“Simple accounting reveals that the Act creates a $23 billion challenge for Ontario businesses over two years. Annualized, this is 21 per cent of what Ontario businesses invest in capital,” Paul Smetanin, President, CANCEA. “Given the significant, sudden and sizable changes it would be remiss to expect that unintended consequences would not follow.” “Given the scale of impact and pace of change, it will be impossible for the provincial government to make businesses, even small businesses, whole through offsets,” added Baldauf. “With amendments to the first reading of Bill 148 due this Wednesday, the legislation will need to see serious change including an adjusted timeline for implementation.” Since Bill 148 was introduced in June, the KOW coalition has called on the government to conduct an economic impact analysis to fully understand how the legislation will change Ontario’s economy. With the government unwilling to do so, the report released today represents the first and only independent economic impact analysis of this legislation. For more details on the economic analysis, click visit keepontarioworking.ca - 30 - About the Keep Ontario Working Coalition: The Keep Ontario Working Coalition (KOW) is a broad-spectrum group of business sector representatives concerned with sound public policy to help produce jobs and grow Ontario. For more information please visit www.keepontarioworking.ca. Members include: Association of Canadian Search, Employment and Staffing Services (ACSESS) Canadian Franchise Association (CFA) Canadian Federation of Independent Grocers Food & Consumer Products of Canada (FCPC) Food and Beverage Ontario (FBO) National Association of Canada Consulting Businesses (NACCB Canada) Ontario Restaurant, Hotel and Motel Association (ORHMA) Ontario Chamber of Commerce (OCC) Ontario Federation of Agriculture (OFA) Ontario Forest Industries Association (OFIA) Ontario Home Builders’ Association (OHBA) Ontario Real Estate Association (OREA) Restaurants Canada Retail Council of Canada (RCC) Tourism Industry Association of Ontario (TIAO) About CANCEA: CANCEA is a state-of-the-art interdisciplinary research organization that is dedicated to objective, independent and evidence based analysis. They have a long history of providing holistic and collaborative understanding of the short- and long-term risks and returns behind policy decisions and prosperity. For more, go to cancea.ca. For media inquiries please contact: Sandra Dueck, Policy Analyst/Communications Specialist Peterborough Chamber of Commerce [email protected] 705.748.9771 x215 About 30 members of the Peterborough Chamber of Commerce were treated to a frank discussion about energy with the provincial Minister of Energy recently. During the 90 minute lunch session, sponsored by Torbram Electric Supply, Minister Glenn Thibeault spent about 15 minutes going over the history of the energy file and how Ontario arrived at its current situation.

Many of our member businesses indicate that hydro has become the second or third largest expense. Chair of the Board Jim Hill said, “Energy, electricity rates and the workings of the energy system have been constant topics of discussion at our chamber policy committee table. Energy is one of the main issues impacting business competitiveness in Peterborough. We were glad to be able to host the Minister of Energy and learn more about the government’s plans moving forward.” The Peterborough Chamber of Commerce works closely with the Ontario Chamber of Commerce (OCC) on these types of policy issues and as the OCC Business Confidence survey found, “22 per cent of OCC members believe that a reduction in electricity costs would have the greatest impact on their organization's health and growth,” said Andrew Thiele, Policy Analyst at the Ontario Chamber of Commerce. “While a further 51 per cent of businesses ranked it among their top three concerns. To ensure Ontario remains competitive, electricity costs is therefore a top priority for the OCC.” Minister Thibeault told the crowd that investments in energy infrastructure upgrades have had the most impact on electricity bills and admitted that the communication on that point was not very clear. Interestingly, the Peterborough Chamber of Commerce wrote a Policy Resolution in 2016, which was approved at the Ontario Chamber of Commerce AGM, asking that the government make public the full breakdown of the cost-drivers behind electricity distribution and generation and how investment decisions since 2003 have impacted electricity cost. The decision to remove coal from the energy supply mix was also highlighted by Minister Thibeault and has resulted in zero smog days in two years. During the question and answer period, Minister Thibeault emphasized that the recent deal with Avista in the northwest United States will not have an impact on customer rates in Ontario. Further questions were asked about Hydro One’s customer service record, to which the Minister replied that the company has achieved significant savings and has agreed to no longer complete winter disconnections or require security deposits for business. When pushed for further details, the Minister acknowledged that more needs to be done and the company is working on doing just that. The Minister was also questioned about the continued increase in generation when conservation initiatives and power use is not peaking anywhere near the amount generated. The Minister’s response was that the province has needed to build capacity to ensure there are no more blackouts or brownouts and also because Pickering Nuclear will be decommissioned in 2024 (pending regulatory approval) and the refurbishment of Darlington Nuclear will bring capacity off line as well. With many businesses and cottagers in the Peterborough area, the Minister was also asked about a seasonal distribution rate and how that could impact those customers. Overall, under the Fair Hydro Plan businesses should see between 3-4% decrease in prices and most Time of Use (TOU) business and residential customers will see a 25% reduction in bills. For Chamber members such as Dynacast, who were able to take advantage of the expanded Industrial Conservation Initiative (ICI), the impact will be real as electricity is their third largest business cost. The Minister wrapped up his time by saying his government didn’t get all of the policies correct around the green energy file and understands that by no means will there be a parade in their honour over electricity; however, the government does recognize there is still a long way to go. As a Chamber representing over 900 businesses employing around 25,000 people, we are looking forward to seeing the province’s long term plan for energy. In a letter submitted to the province during the consultation phase we asked for several considerations including that the Ministry look at energy through the lens of the small to medium-sized business owner working to keep people employed who simply want a system in the future that is predictable, transparent and reliable. The Department of Finance Canada is considering major changes to how corporations are taxed. The proposed rules could have a significant impact on many Canadian businesses: potentially raising taxes, increasing the administrative burden on SMEs and heightening the impact on family-run businesses.

On July 18, Finance Canada launched a consultation on how “tax-planning strategies involving corporations are being used to gain unfair tax advantages.” The document contains proposed policies to close these “loopholes”. There are four key changes that will affect business:

In particular, we are looking for detailed examples and cases of how a specific small business will be affected by the changes. We feel concrete examples will be most effective in making our case for easing the changes. We would ask that you send them in by August 11. Click here to view the consultation documents released by Finance Canada. To provide feedback on these proposed changes email: [email protected] |

AuthorThe Peterborough and the Kawarthas Chamber of Commerce acts as a catalyst to enhance business growth, opportunity, innovation, partnerships and a diverse business community. Archives

June 2024

Categories |

|

Copyright Greater Peterborough Chamber of Commerce. All rights reserved.

175 George Street North, Peterborough, ON, K9J 3G6 Phone: (705) 748-9771 | (705) 743-2331 Home | Calendar | Site Map | Privacy | Accessibility |