Ontario Chamber of Commerce (OCC) President and CEO, Allan O'Dette, has sent a letter to the Honourable Chrystia Freeland, Canada's Minister of Foreign Affairs. In their message on the eve of the inauguration of Donald Trump as President of the United States of America, the OCC brings attention to the vital importance of growing our relationship with our southern neighbour. "We believe that trade between Canada and many American states yields positive outcomes for workers on both sides of the border." Read the letter UPDATE: Employer Sponsored Health Benefit Plans Will Not Be Taxed Thank you to all of our members who wrote letters expressing the need to maintain the tax-free status of employer-sponsored health benefit plans - your voice was heard! Last week the Prime Minister stood in the House of Commons and in response to a question from the opposition leader said these plans would not be taxed. Here’s the excerpt from the exchange between the PM and the Opposition Leader: Hon. Rona Ambrose (Leader of the Opposition, CPC): Mr. Speaker, millions of Canadian workers will be forced to pay the Liberals' new tax on health and dental benefits. Many will lose their coverage and find themselves paying out of pocket for important expenses like life-saving medicines, mental health counselling, and their children's braces. It is not fair that the Prime Minister racks up billions of dollars in spending on his priorities and now Canadians have to pay for it with a $1,000 new tax on their health and dental benefits. Why would the Prime Minister even consider doing this? Right Hon. Justin Trudeau (Prime Minister, Lib.): Mr. Speaker, we got elected on a commitment to invest in the middle class, to support the middle class and those working hard to join it. The very first thing we did was lower taxes on the middle class and raise them on the wealthiest 1%. We are committed to protecting the middle class from increased taxes and that is why we will not be raising the taxes the member opposite proposes we will do. Preparation for the 2017 Federal Budget is now underway and the Canadian and Peterborough Chambers of Commerce want to emphasize to the government the importance of maintaining the tax-free status on employer-provided health care benefits.

A recent article in the National Post, questions in the House of Commons before the break, and calls to the Minister of Finance’s office have brought to light that government has identified taxing health and dental benefit packages as a possible source of additional revenue for the federal government, under its commitment to review $100 billion in forgone federal revenue. Interestingly, the recommendation was made in the 2015 Report of the Advisory Panel on Healthcare Innovation under the heading “Financial Fairness In a Period of Transition”:

We don’t know if the government is planning to implement this recommendation as is, but the whole issue of taxing health care benefits is a huge red flag for the business community and employees who depend on these plans for preventative care. Taxing health care benefits would cost employees hundreds, if not thousands of dollars each year, and could result in fewer employers offering these plans. For example, if your premiums were $5,000 a year, that cost would be viewed as a taxable benefit and added to your total taxable income for the year (see box above). Preventative care includes vision care, prescription drug, mental health services, dental care, occupational therapy, and physio, chiro, and massage therapies. Taxing health benefits could limit use of preventative measures by Canadians and put added stress on the health care system as a whole. The Canadian Chamber of Commerce has found that Finance Canada estimates that exempting employer-provided health benefits results in about $2.9 billion in forgone tax revenue. However, that generates $32.2 billion in additional health care benefits for Canadians. “We know that healthy employees are productive employees," says Monique Beneteau, Health Promoter with Peterborough Public Health. "Without access to benefits, one could anticipate higher rates of absenteeism and presenteeism. I would think that taxing employee health benefits, where the majority of workers are employed in small businesses and receiving very modest pay, could be the difference between making ends meet and living in poverty while working.” When Quebec introduced a similar tax, 20% of employers dropped health and dental benefits for employees. Studies suggest the removal of this tax benefit across the board could result in a decrease of 50% of small firms that will be able to offer health benefits. The impact of such a tax is far reaching, with about 24 million Canadians using employer-provided health care benefits. While in Peterborough for a Town Hall recently, Prime Minister Trudeau made numerous references to his government’s intention to grow the middle class. It is believed this type of tax will not accomplish that goal, but rather create unintended consequences in other areas of health care. It will not bring more fairness to Canadians or simplify the tax code. It will download further complexity onto Canadian employers and potentially leave Canadian families without access to the care they need. The Canadian Chamber of Commerce has prepared an email letter template. We are asking that you urge the government, through your MP, to maintain the tax-free status of employer-provided health care benefits. Email Template Questions? Email: [email protected] Cap and Trade is in effect in the province of Ontario. It will impact businesses and residents. Learn more

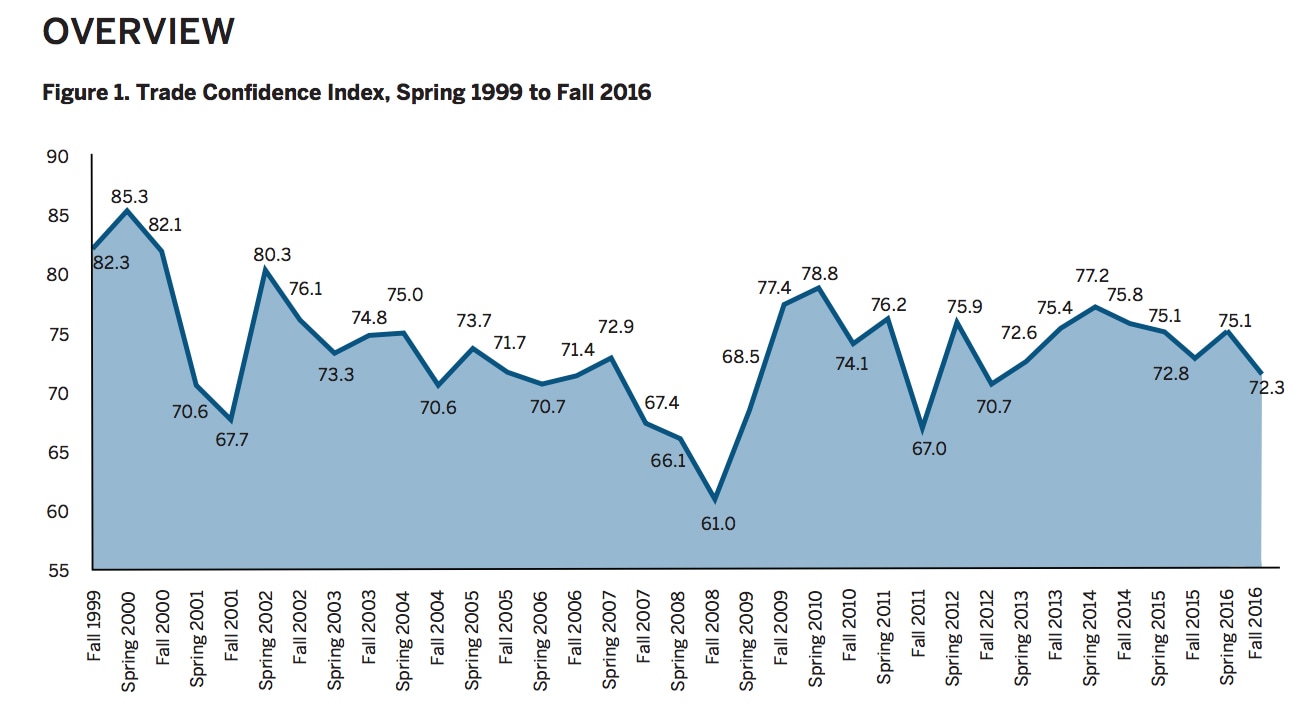

Export Development Canada (EDC) has released its latest Trade Confidence Index (TCI). What does it say about how confident Canadian business is about the world outside our borders? What world issues are on the minds of Canadian business when they are looking to export? “Canada is an exporting nation and the USA represents 80% of our export market,” says Rhonda Barnet, VP of Finance for Steelworks Design in Peterborough and Chair of the Board, Canadian Manufacturers & Exporters (CME). “Given the current US political uncertainty, many manufacturers have put off or delayed major investment decisions across North America to see what actions are realized by President Elect Trump that could impede our integrated supply chains. Some industry pillars like automotive have experienced significant growth while others like Oil and Gas have struggled. The offset in Canada has been neutral to slightly negative growth for our sector. There is still great opportunity for growth in our sector. We need to focus our government and our factories on innovation and productivity.” EDC has been conducting the TCI twice a year since 1999. The Crown Corporation calls it “a pulse check of Canadian exporters’ level of confidence and their projections for international trade opportunities". The score is based on five elements:

Overall trade confidence dropped in 2016, according to EDC, from a score of 75.1 in the spring to 72.3 in the fall. It’s the lowest level of trade confidence since the fall of 2012. However, the report goes on to say that the vast majority of respondents anticipate conditions to remain the same or improve across all five of the TCI elements, with the greatest optimism for export sales. The low Canadian dollar was cited by some respondents as the reason for improvement in international business opportunities, while others cited world instability and concerns about oil and gas production as the reasons why such opportunities would worsen. Optimism and hope for the world’s emerging economies was given as the top reason by those anticipating a positive outlook to world economic conditions. Among those with a negative outlook on world economic conditions concerns about world recession or global instability were mentioned along with the conflict in the Middle East. On the index element of domestic sales, those with a positive view cited acquisition of new customers or contracts as the main reason, while those with a bleaker outlook mentioned seasonal activity or demand as the driving factor for that expectation. Expectations for domestic economic conditions slipped from spring of 2016 to fall of 2016, however those who felt an upturn was at hand and those who felt a more negative outlook was more realistic cited very similar reasons: the oil and gas industry, political change and government initiatives and the value of the Canadian dollar. When the numbers are displayed by business size, small, medium, and large enterprises all expected exporting conditions to worsen. When asked what the major issues were impacting international markets and trade activity, the majority of respondents ranked the outcome of the US election as their top priority followed by the slowdown of growth in China and then the Brexit vote. Close to half of the respondents to the survey reported having plans to export to new countries in the next two years, with China, Germany and the UK listed as potential market destinations. Only 32% of respondents indicated they would be hiring over the next six months. 74% said accessing skilled labour is moderately or very difficult. This is up 2% from the spring survey. Of those surveyed 15% made investments outside of Canada, mainly in the form of foreign sales or branch offices, warehouses, and plants. The main reason for investing outside of Canada was to increase market penetration. The US continues to rank as the most common destination for current exporters and foreign investment. The low Canadian dollar continues to have positive impacts on the export sales of survey respondents. The survey was conducted by telephone in September and October of 2016. Read EDC Reports  This is Ontario’s first week with the cap and trade program in effect. At the end of 2016, a coalition of Chambers asked the provincial government to defer the program for a year. Why? Several reasons including the cost of the program on top of electricity prices that continue to go up, the lack of a sector by sector analysis of the impact of the program, the uncertainty about the new administration in the United States, and the fact that the federal government has said all provinces must be on board with either cap and trade or a carbon tax by 2018. The ask to the provincial government is not about sitting still and doing nothing about our environmental challenges; it’s about understanding the true impact of a program on the Ontario economy. Gas prices went up on January 1st – the business with a fleet of vehicles to fill to keep goods moving to and from their destination just experienced an immediate increase. How are they to absorb this and are they confident that the increase will be returned to them in a meaningful way? The Minister of Energy was quoted in a Toronto Star article as having said that the cap and trade program is simply the cost of doing business. It’s a hard pill to swallow for many businesses after a series of legislated increases such as WSIB, increasing electricity prices, College of Trades and various other compliance measures that have been chalked up to the “cost of doing business”. At the Chamber level we have called this stacking of legislative costs the cumulative burden. In isolation from each other, each of these programs has merit, but when you start adding up the full impact of implementation of each of them over the past several years, it’s no wonder business confidence is lagging. “Amazon, after its announcement to set up a location in Montreal, cited the cost of hydro as one of the main factors in their decision to choose Quebec over other locations including Ontario,” says Stuart Harrison, President & CEO, Peterborough Chamber of Commerce. “Leland Industries CEO Byron Nelson also attributes Ontario’s uncompetitive electricity costs for their recently announced expansion to Illinois, adding that Leland will no longer invest in Ontario. That should be a red flag to our provincial government.” In Ontario, since 2004, electricity prices have increased by 383%, from a flat rate of 4.7 cents a kilowatt hour to 18 cents a kilowatt hour at peak times. The introduction of the cap and trade system will add further charges on natural gas, gasoline and diesel fuel that will be keenly felt by every individual and business in Ontario. In the auditor general's report, electricity prices are projected to increase by 14% for businesses and 25% for households; after applying the $1.32 billion in revenues planned to be spent by the Ministry of the Environment to mitigate electricity prices, businesses will still face a 13% increase and households 23%. So why is the government rushing this program? There are programs in existence to help businesses improve lighting and the like. In fact, the Peterborough Chamber is hosting an information session about such energy efficiency programs at our Lunchbox Learning event on Wednesday, January 18, 2017. There is no doubt these programs have been important cost savers for a number of local businesses. The cap and trade program will also generate significant revenue – about $8 billion between 2017 and 2020, according to the provincial auditor general. But will that money be pushed back into the economy to maintain and improve competitiveness for business? How will the portion paid in by business be returned to the business community? As well, with the recent federal policy calling for the provinces to have plans in place by 2018, deferring the program for at least a year to better understand and communicate the exact impact would benefit all. Currently, Quebec and Ontario have cap and trade; Alberta and BC have a carbon tax. There is value in leaving the decision to each province, but that also poses challenges for businesses with multiple locations and conducting business in multiple jurisdictions. The Chamber Network passed a resolution at the Ontario Chamber of Commerce AGM in May 2016. The first recommendation was that the program be deferred until 2018. Ontario has already made great strides in reducing Greenhouse Gas Emissions (GHGs) with the elimination of coal. This is a success like no other. However, it is anticipated that the cap and trade system will result in only a small portion of the required greenhouse gas reductions needed to meet Ontario’s 2020 target. The message around cap and trade is simple. Our members tell us: “Business loves certainty” and without it, they are less likely to hire and invest in themselves. Certainty can be achieved through transparent government policies that provide businesses a strong foundation from which to operate and compete.  If you are a regular reader of this page, you’ll have a sense of the type of work we are involved in at the Chamber of Commerce. As much as the word has taken on some darker undertones in the last few years, we are lobbyists for the business community. We belong to both the Ontario Chamber and the Canadian Chamber networks and as such are able to voice your concerns at all three levels of Government: Municipal, Provincial and Federal. We employ a full-time Policy Analyst, Sandra Dueck, whose byline you normally see in this space, and who does an amazing job of studying the issues, lobbying the appropriate halls of power, and communicating it all to you here on this page, in her weekly television feature, on our website and on social media. Sandra’s policy work was recognized this year when she was awarded the Staff Person of the Year from the Canadian Chamber of Commerce. She is indeed the best in the country… Here is a sampling of the policy work completed on your behalf this year: Four policy resolutions were advanced by the Peterborough Chamber (Policy Resolutions are approved at the Municipal level by our Policy Committee and Board of Directors, at the Provincial level by the delegates to the Ontario Chamber AGM and the Federal level, by the delegates to the Canadian Chamber AGM). They are: o Federal level

2. Restoring Canada’s Innovation Competitiveness

processing, and automotive parts manufacturing and will also be adding the tourism sector into the mix. o Locally

offering specific programming for the local business community such as our Power Hour, PBX, Trade Shows, Next Level and Leaders Lunches, all designed to Strengthen Business.  Peterborough City Council has approved the 2017 budget. What will you see in it? A two percent increase in the general levy and a .72 percent increase for capital funding support for a total of 2.72 percent. Let’s take a look at some of the budget highlights for business as presented in the budget highlight book: On the operating side, the Tax Ratio Reduction Program proposed by the Peterborough Chamber of Commerce, Kawartha Manufacturers Association, and Peterborough and the Kawarthas Association of Realtors for the Commercial and Industrial property owners will continue on the timeline established in the 2016 budget. This means that Peterborough businesses can continue to remain competitive with similar businesses in other communities. For example, consider two businesses in the same sector with the same bricks and mortar footprint. In the past, the business in Peterborough could be paying up to $30,000 more in taxes than the business in the other community. The Tax Ratio Reduction Program is designed to even the playing field with other Ontario communities and bring the City of Peterborough into the province’s range of fairness. The City will pay 1,052.6 full and part-time equivalent employees $98.7 million for salaries and benefits in 2017. On the capital side, the 2017 budget includes 193 projects totaling $79 million. The money raised through the one percent increase for capital funding will be used to help increase the amount of money the City can safely borrow by $16.6 million. Some of the projects on the table include:

Also receiving a push forward is the Charlotte Street renewal and Louis Street Urban Park project. $700,000 is included in the 2017 budget. However, another $2.1 million will be required to complete the work. When done, it's anticipated the project will help stimulate renewal in the Downtown Core and the Charlotte Street West Business District. The new arena facility project to replace the Northcrest Arena will receive $1.2 million in 2017. This money will be used to get a detailed design completed and Request for Tender (RFT) documents prepared. Beyond 2017, $30.3 million will be required to complete the project. City staff expect about $11.6 million to come from development charges, leaving the City to fund $18.7 million from other sources including user fees, community sponsors, grants or tax supported debt financing. The City has also submitted an application to the Ontario 150 Community Capital Program for a $300,000 grant supporting the $600,000 rehabilitation of Barnardo Park in 2017. An always contentious issue is the Police Services Budget, which has been approved in full for operations, with a suggestion to delay replacing a vehicle for a year as a way to save money. The total budget is just under $25 million. The budget process is one of reflection and sets the blueprint for action for the coming year. It’s a process that happens in individual communities and has an impact on all citizens. In a recent interview for the Chamber's Business 911 program, Peterborough City CAO Allan Seabrooke spoke of the importance of capital projects and how improving the city helps with business attraction and retention. The budget process is not one that exists in isolation. A municipal budget is also reflective of the political environment and policies at the provincial and federal levels. Consider the new federal funding for public transit infrastructure. Those projects can happen at a faster pace with federal funding. But this type of funding is not always available and may only be available to use in a specific year. At the provincial level, after many years of downloading services to municipalities, there has been some uploading of services back to the province. But there is one area in which chambers of commerce and boards of trade are asking for reform and that is in the interest arbitration system. Interest arbitration is the only legal mechanism available to Ontario municipalities for settling disputes from contract negotiations with essential service providers. The call is to ensure that this system reflects the municipality’s ability to pay increased costs (Obstacles and Opportunities: The Importance of Small Business, OCC 2016). This is a good budget, a responsible one, but remember it still does not solve all of the City’s issues. There are still a lot of infrastructure dollars needed for capital projects and raising those dollars will be a continuous challenge. |

AuthorThe Peterborough and the Kawarthas Chamber of Commerce acts as a catalyst to enhance business growth, opportunity, innovation, partnerships and a diverse business community. Archives

June 2024

Categories |

|

Copyright Greater Peterborough Chamber of Commerce. All rights reserved.

175 George Street North, Peterborough, ON, K9J 3G6 Phone: (705) 748-9771 | (705) 743-2331 Home | Calendar | Site Map | Privacy | Accessibility |