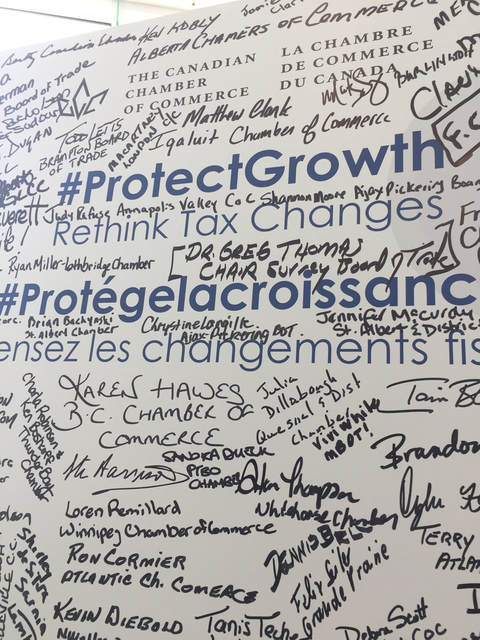

Members from hundreds of chambers of commerce across Canada were not reassured by Finance Minister Bill Morneau’s response to their concerns about the government’s proposed tax changes. The Minister addressed delegates at the Canadian Chamber of Commerce’s annual general meeting in Fredericton on Saturday, September 23rd. “While we are grateful to the Minister for taking time out of his schedule to speak to our members, we did not receive any new information or assurance about the potentially crippling effects his tax reforms could have on small and medium-sized enterprises,” said the Hon. Perrin Beatty, President and CEO of the Canadian Chamber. Following Minister Morneau’s post-speech press conference, Mr. Beatty was accompanied by representatives of provincial chambers and by five local business owners, who are deeply concerned about these measures. “In speaking with our network of more than 200,000 businesses, it is the farmers, mom and pop shops, and entrepreneurs who invested everything into their businesses who are most scared of the government’s proposed tax changes,” Mr. Beatty said. “The government has not answered their concerns today. It has left them high and dry, wondering how they will survive if the weather or the economy takes a turn for the worse.” Delegates at the AGM debated more than 70 resolutions, in setting the Chamber’s policy agenda for the year ahead. Included in this year’s resolutions is a call to government to extend its 75-day consultation period for the tax changes and bring in an independent commission to review the full impact of the changes. “Businesses have a right to be heard. The government’s process on this issue needs to be stopped and replaced with genuine consultations,"concluded Mr. Beatty. Your chamber, in collaboration with the Canadian Chamber of Commerce, has launched Protect Growth, a national campaign to ensure the voice of business is heard before any changes to the tax code are made. The government's proposed changes are the most dramatic in 50 years and could affect you if:

The rules would apply to all incorporated businesses in Canada. Two thirds of small business owners earn less than $73,000 per year and half of those earn less than $33,000. 93% of Peterborough Chamber members are small businesses. For more information about this campaign, and how you can speak up, visit protectgrowth.ca. Comments are closed.

|

AuthorThe Peterborough and the Kawarthas Chamber of Commerce acts as a catalyst to enhance business growth, opportunity, innovation, partnerships and a diverse business community. Archives

June 2024

Categories |

|

Copyright Greater Peterborough Chamber of Commerce. All rights reserved.

175 George Street North, Peterborough, ON, K9J 3G6 Phone: (705) 748-9771 | (705) 743-2331 Home | Calendar | Site Map | Privacy | Accessibility |